This material belongs to: South China Morning Post.

From obscurity, Ye Jianming built a business empire with 263 billion yuan in sales before he turned 40, and began shopping for energy assets around the world, mostly funded by China’s state banks.

Ye Jianming, the Fujian entrepreneur who took fewer than five years to rise from obscurity to become head of China’s fourth-largest oil conglomerate, has been detained for questioning, according to four sources familiar with the matter.

Ye, ranked two spots ahead of French president Emmanuel Macron in Fortune magazine’s ‘40 Under 40’ list of the world’s most influential young people in 2016, was detained just before the start of the Lunar New Year celebrations on February 16, a source told the South China Morning Post, declining to provide his name for disclosing a matter under investigation.

Caixin magazine earlier reported that Ye had been taken away for questioning, but the Chinese-language version of the story appeared to have been removed from its website, although the English version remains.

Shares of three companies linked to Ye’s flagship company CEFC China Energy plunged on stock exchanges in Hong Kong, Shenzhen and Singapore, wiping out as much as 4 billion yuan (US$630 million) in combined market value within an hour of trading. The stocks rose later in the day to pare back losses.

A CEFC spokesman in Shanghai responded by text that the company “has nothing to announce for the time being,” declining to elaborate.

The detention of the low-profile entrepreneur follows the November 21 arrest in New York of Hong Kong’s former Home Secretary Patrick Ho Chi-ping, on charges of routing bribes for African government officials through US financial institutions.

Ho, 68, was leading a life of what he called “civil diplomacy” since his retirement from Hong Kong’s public service, heading a think tank called the China Energy Fund Committee, fully funded by CEFC. The think tank has special consultative status with the United Nation’s Economic and Social Council, with access to influential decision makers in UN bodies.

Ho and Senegal’s former foreign minister Cheikh Gadio operated “an international corruption scheme that spanned the globe” since 2014, according to a November 20, 2017 statement by the US Department of Justice. The two men allegedly offered a US$2 million bribe to Chad’s president Idriss Deby in exchange for “valuable oil rights,” and another US$500,000 to Uganda’s Foreign Affairs Minister Sam Kutesa.

Ye’s detention in China was ordered directly by the Chinese president Xi Jinping, according to a source familiar with the matter. It marks a remarkably speedy downfall for an entrepreneur who was still making waves three months earlier. CEFC made its third media and communications asset in the Czech Republic in November, leading a consortium that would pay €500 million (US$609 million) to buy the majority of Czech broadcaster CME from Time Warner.

Two months earlier in September 2017, CEFC paid US$9.1 billion for 14.2 per cent of Russia’s state-backed oil company Rosneft, becoming one of the largest shareholders in the world’s largest listed oil firm by production.

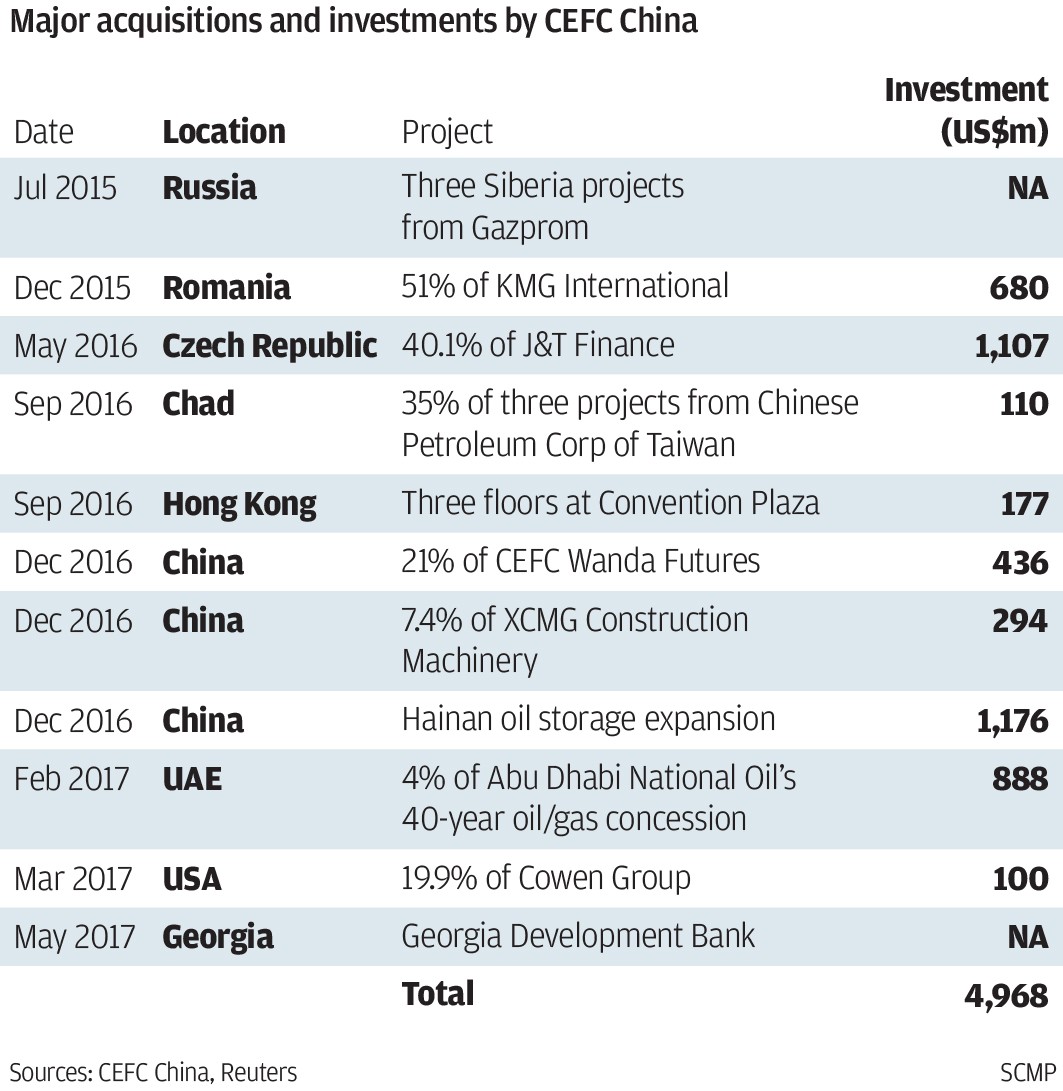

Shanghai-based CEFC, established by Ye in 2002 when he was in his mid twenties, had spent at least US$1.7 billion since 2015 buying energy-related businesses in Romania, the United Arab Emirates, Russia and even Chad, not including another US$1.2 billion buying financial services in the US and in the Czech Republic.

Due partly to Ye’s investments in the country, the Czech Republic’s president Milos Zeman was the sole European Union leader to join a 2015 military parade in Beijing to commemorate the end of the Second World War.

Ye, whose aggressive shopping spree had been attributed to the mistaken association of him with the family of the late Ye Jianying – who as head of China’s legislature from 1978 to 1983 was also the de facto head of state – is actually the son of an ordinary worker’s family in Fujian province, according to people who know both families.

After working briefly as an enforcement officer with the forestry department, he earned his first pot of gold helping to extricate a Hong Kong businessman from financial strife and complete a real estate transaction, according to Depth-paper, a Chinese news portal.

From there, he bought at auction the oil businesses that the government had confiscated from Xiamen’s smuggling kingpin Lai Changxing, using loans from state banks, as well as investors in Hong Kong and Fujian to finance his purchase, he told Fortune in an interview.

By 2015, Ye had built up a business empire with 263 billion yuan in revenue, 60 per cent of which was from the trading of oil and gas. CEFC then embarked on an overseas shopping spree, starting with a US$680 million purchase of a majority stake in the overseas unit of Kazakhstan’s state oil company. Subsequent acquisitions extended across eastern Europe, the Middle East and Africa, mostly in oil and gas. He made waves in Hong Kong when CEFC paid HK$1.4 billion (US$177 million) for three floors of office space at the Wan Chai Convention Plaza, with views of Victoria Harbour.

His biggest acquisition had been his investment in Rosneft, chaired by Igor Sechin, a close ally of Russian President Vladimir Putin. The deal was financed primarily by state banks in Russia and China.

China Development Bank, a state lender established with the charter to provide funding for projects aligned with Chinese state policies, has been CEFC’s biggest financier since the company’s establishment.

The Beijing-based lender extended 32.3 billion yuan of loans, or 87.5 per cent of total bank borrowings, according to the September 2016 bond prospectus of its principal subsidiary CEFC Shanghai International Group.

info@anticorr.media

info@anticorr.media