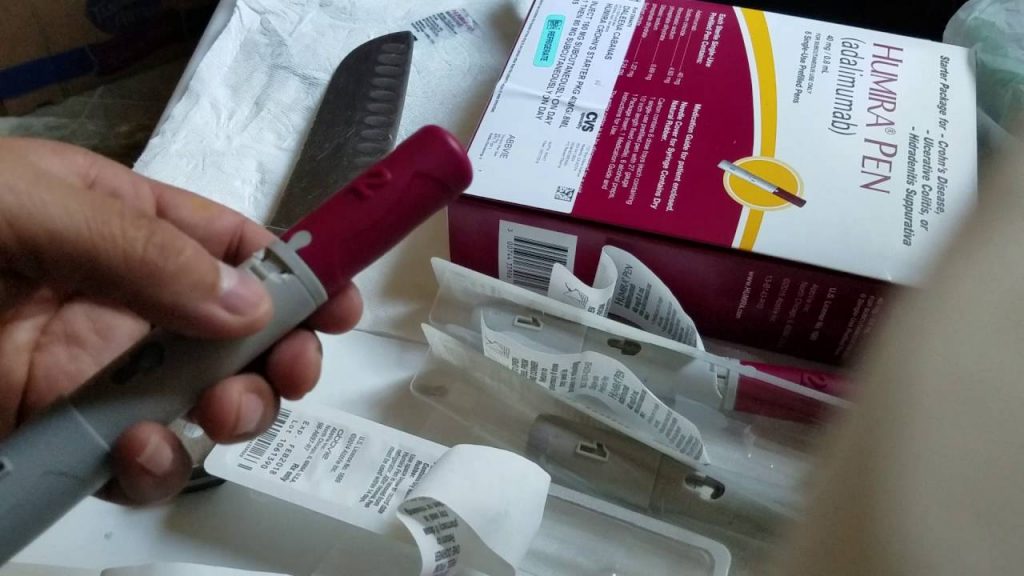

Regulator the insurance regulator filed a lawsuit against the biopharmaceutical company AbbVie Inc., arguing that the pharmaceutical giant has given illegal kickbacks to patient doctors more often prescribe Humira, which is used to treat rheumatoid arthritis.

The company ” worked on a well-designed scheme involving both classic kickbacks – cash, food, drinks, gifts and travel – and more sophisticated – free and valuable professional goods and services for doctors,” the California Department of insurance said in a statement. It is reported by Bloomberg.

According to officials, AbbVie paid registered nurses that they became “representatives” of the company to work with patients. Nurses, talking with patients and doctors, downplayed the risks when taking the medicine, the statement said.

“AbbVie has spent millions on convincing patients and professionals of health, in fact, the ambassadors were defenders of Humira, who were hired to keep patients on the dangerous drug at any price,” said Commissioner of insurance Dave Jones.

The alleged misconduct is “particularly egregious because it is known that the drug has very adverse side effects,” Jones said at a press conference.

“Such allegations have no basis,” AbbVie spokeswoman Adele Infante said. According to her, the company works according to the state and Federal laws regulating interaction between medical workers and patients. The company’s services help patients and “in no way replace or interfere with the interaction between patients and health care providers,” she said.

According to Jones, private insurers paid $ 1.2 billion in claims related to Humira, one of the world’s best-selling drugs.

Florida, too, against AbbVie

AbbVie’s shares fell after news of the trial, dropping 2.9 percent to $ 92.61 in new York city. Jones intervenes in a whistleblower complaint filed in California by a nurse who a few years ago was hired as an “AbbVie representative” in Florida. The claim filed with the Supreme court of Alameda County is three times the number of claims brought against Humira as a result of the alleged setbacks. The lawsuit includes private insurance claims, said Nancy Kincaid, a spokeswoman for the California Department of insurance.

“We conducted an investigation. We believe that there is strong evidence that the fraud was committed against private insurance companies, ” said Kincaid.e insurers have paid out $1.2 billion in Humira-related claims, according to Jones.