Sberbank of Russia was put under the European and U.S. sanctions three years ago. When it happened the experts stated: “the bank has nothing left to do but to search for money inside the country”. And they were right in their assessment. The Country’s major bank obtained funds by putting pressure on its own Russian businessmen.

As admitted by Herman Gref, the CEO of Sberbank, 2014 became a nightmare for Sberbank when it suffered from sanctions and collapsing currency, while in the end of the year the depositors debited their accounts by 1.3 billion rubles in total. Although it was necessary to raise funds inside the country Sberbank began to remit money offshore. However the money belonged to deceived Russian businessmen.

Sberbank remitted 24 million U.S. dollars offshore

24 million U.S. dollars is about the sum Sberbank paid ZAO “Kompaniya AKS” for renting the central office in Moscow. While the promoters of this company are the offshore organizations on Virgin Islands.

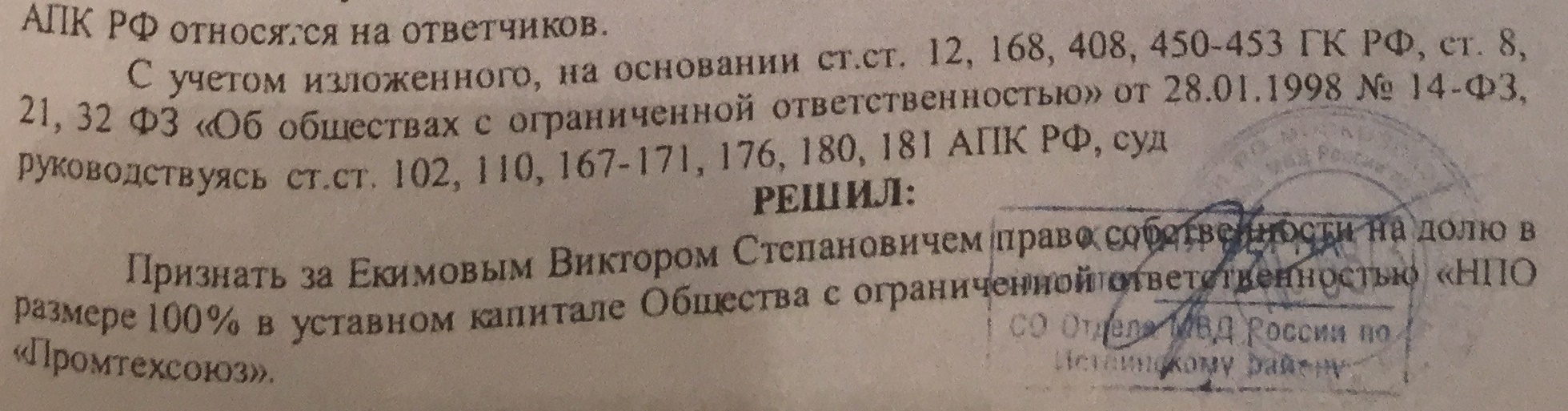

The major bank of Russia concluded rental contract with the Russian organization “Promtehsoyuz”. This company holds the business-center “Akademicheskiy” where the central office of Sberbank is located. Sberbank transferred 1.25 million dollars per month to Victor Churin, the building owner, but when Churin lost his business by forged law decision Sberbank authorities readily signed lease assignment agreement. Thus the Russian organization assigned lease rights to the company established by offshore organizations. As a result the money of Russian investors began to flow offshore, and Sberbank was never confused about it although it was expected to fulfill the economic recovery program and develop anti-sanction measures. Sberbank, where 51 % is owned by the government, did not support deoffshorization in Russia as well.

Even when Russian mass media revealed the forged law decision which was a ground for property registration, the bank did not bother to find out why the company which owns the building is controlled by some other holder now. According to the law decision the new holder received 51 % of business, however the tax office which registered the title of property also has the law decision unsigned by the judge, which declares that the new holder owns 100 %.

The fact of forged law decision is being inspected by the Russian Investigative Committee for a year but they cannot come to any conclusion. On the other hand, during the same year Victor Churin and the former company director who has been put under house arrest were blamed with trickery by the Russian Investigative Committee. Being in such a difficult situation it is very difficult for the aforementioned persons to fight under pressure from the Russian legal system.

The claims of foreign companies against Herman Gref

The American company “PPF Managament” filed a lawsuit in USA against Herman Gref, the CEO of Sberbank. This case concerned bankruptcy of the large Russian company “Pavlovskgranit” owned by the businessman Sergey Poymanov.

The company experienced illegal takeover right when the crisis emerged. Poymanov was holding negotiations concerning the debt restructuring, but Sberbank reassigned the debt to its affiliated company, and then to the offshore company. The “Pavlovskgranit” company (valued 750 million dollars) was brought to bankruptcy and Poymanov himself was imprisoned despite the fact that he provided mass media with the documents confirming payment-worthiness of the company and his intention to pay back a loan in full.

Bankruptcy of a Debtor as a business disposition scheme

Sberbank uses this scheme to drive to bankruptcy the large-scale-production enterprises, as well as medium and small-sized businesses. Businessmen from Tver took up a loan in Sberbank to construct a shopping mall. Numerous property holdings of these businessmen were used as a loan collateral. When the construction of the shopping mall was completed, economic dispute arose between its proprietors and construction company “Spetsmontagestroy”. As a result of this dispute constructors demanded the bankruptcy of the company, and Sberbank instantly became a member of the register of creditors.

Businessmen from OOO “Irtysh” were meant to sell one of the collateralized facilities in order to get out of debt. Parties made an agreement according to which the debtor should pay a percent to Sberbank from each square meter of the sold property, therefore reducing the principal amount of a debt.

Negotiations with the Sberbank began. Businessmen were granted a loan till 2022 and they did not experience any payment problems before. With that in mind businessmen decided that this issue can be settled in the regular course of business. However Sergey Yuschenko, Sberbank Department Head in Tver, had for some reason changed his mind and declined the sale of collateralized property by the businessmen.

There was a bankruptcy procedure initiated in relation to OOO “Irtysh”. However, instead of restoring an enterprise Stanislav Sineokiy, bankruptcy supervisor, began to rise lease rates and cancel agreements with lessees. The profit of the shopping mall droped, and very soon all business assets seem to come under the hammer at a underestimated price. And the the buyer will become Mr. Igor Ivanov – an owner of the company “Spetsmontagestroy”. He has already claimed that he paid off the debt of the company to Sberbank. The price of the business has already been evaluated at 139 mln. rubles, which is well below the net cost price of 300 mln. rubles. In this case the market price of the aforementioned business will be 450 mln. rubles.

What does Sberbank get out of this?

What does the Government represented by Sberbank get after all these scandals? Nothing! Just like with the case of business-center “Akademicheskiy”, “Pavlovskgranit” or Tver shopping mall all the profit is gained by the few selected people who are close to chief executives of the major bank of Russia. In case of Tver the people involved with the disposition are the same people who will gain as a result of the bankruptcy being filed. When the assets of OOO “Irtysh” will be sold for the aforementioned 139 mln. rubles, the initial creditors won’t be able to recover their financial losses. The ones being majorly hurt will be the current owner and Sberbank itself.

Illegal takeovers of business in Russia are carried out with the help of the world giant in banking sector. Perhaps it is one of the reasons why the western countries are not eager to collaborate with Russian bankers.

Attempted assassinations against loan debtors

Now Sberbank sues to become a member of the register of creditors of OOO “Irtysh”, despite the fact that the loan is secured by a pledge. Consideration of the case will take place in the Commercial Court of the Tver Region on April 13, 2017. The verdict is to be delivered by the judge Irina Shabelnaya.

Unlike the aforementioned characters of this article the owner of OOO “Irtysh” is not imprisoned yet. But he is even less fortunate. Andrey Zharov survived the assassination attempt: some criminal sprayed a pepper-spray ball into his eyes and cut his face and body with a knife. His lawyer’s office was blown up and burnt to the ground.

Before you take out a loan in a Russian bank always keep in mind that you will probably have to pay off not only the debt, but also the unforeseeable interest.